Looking Ahead: Middle Market M&A Trends for H2 2019

This article is an excerpt from The Northern Edge Deal Update for August 2019. Get the full pdf here.

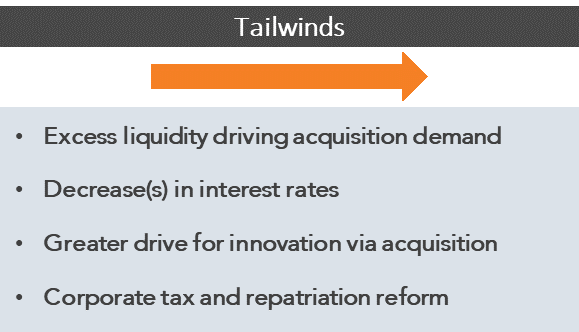

Liquidity and Future Interest Rate Cuts Will Sustain Acquisition Demand

- Significant levels of cash on corporate balance sheets and equity capital raised by financial sponsors

- Private equity and venture capital firms sitting on ~$1 trillion of “dry powder” (Source: Pitchbook)

- In a low organic growth environment, many companies will look to grow via acquisitions

- The Fed has stated that it will “act as appropriate to sustain the expansion” of the current economy – Fed interest rate cuts in the future will only help to increase acquisition demand

Interest Rate Cuts by the Fed Will Lower the Cost of Borrowing

- The Fed has just announced an interest rate cut of 0.25%, the first in more than a decade

- Many believe the Fed is also likely to cut rates at least one more time before January 2020

- As the cost of borrowing lowers and transaction multiples remain constant, the effective purchasing power of potential buyers increases

Trade Wars May Affect Valuations if Margin Degradations Persist

- Tariffs are increasing operational costs for companies across many industries

- Trump stated on June 29th that, while negotiations continued, he would not increase further the existing 25% tariffs on approximately $250 billion of Chinese goods. In a subsequent tweet on August 1st, Trump stated “The U.S. will start, on September 1st, putting a small additional Tariff of 10% on the remaining 300 Billion Dollars of goods and products coming from China into our Country.” Meanwhile, the Eurasia Group forecasts only a 45% chance that a deal is made between China and the United States before the end of 2019

- Firms will be wary of higher input costs and their impact on profit margins

Yield Curve Inversion May Scare Potential Buyers

- The recent 10Y-1Y treasury yield curve inversion suggests an incoming economic recession, which may discourage potential buyers from making acquisitions

- The yield curve inversion is known to precede recessions by anywhere between two to six quarters, which means

- Q4 2019 is likely the earliest time a recession might occur